One-Stop-Shop (OSS) EU VAT for E-Commerce

Significant reform has simplified EU VAT compliance especially for e-commerce businesses and tax advisors, but it comes with a number of challenges.

In this blog post you can find out everything you need to know about the One-Stop-Shop (OSS) scheme, including registrations, returns, scope and exceptions. Get informed about your VAT obligations for cross-border sales in the EU.

We Can Help

We offer an automated solution for the One-Stop-Shop. You can learn more about it in a personalised live demo which you can book here.

Summary: The Most Important Facts About the One Stop Shop

Here are the most important facts that you as an e-commerce business or tax advisor should know and observe following the introduction of the OSS on 1 July 2021:

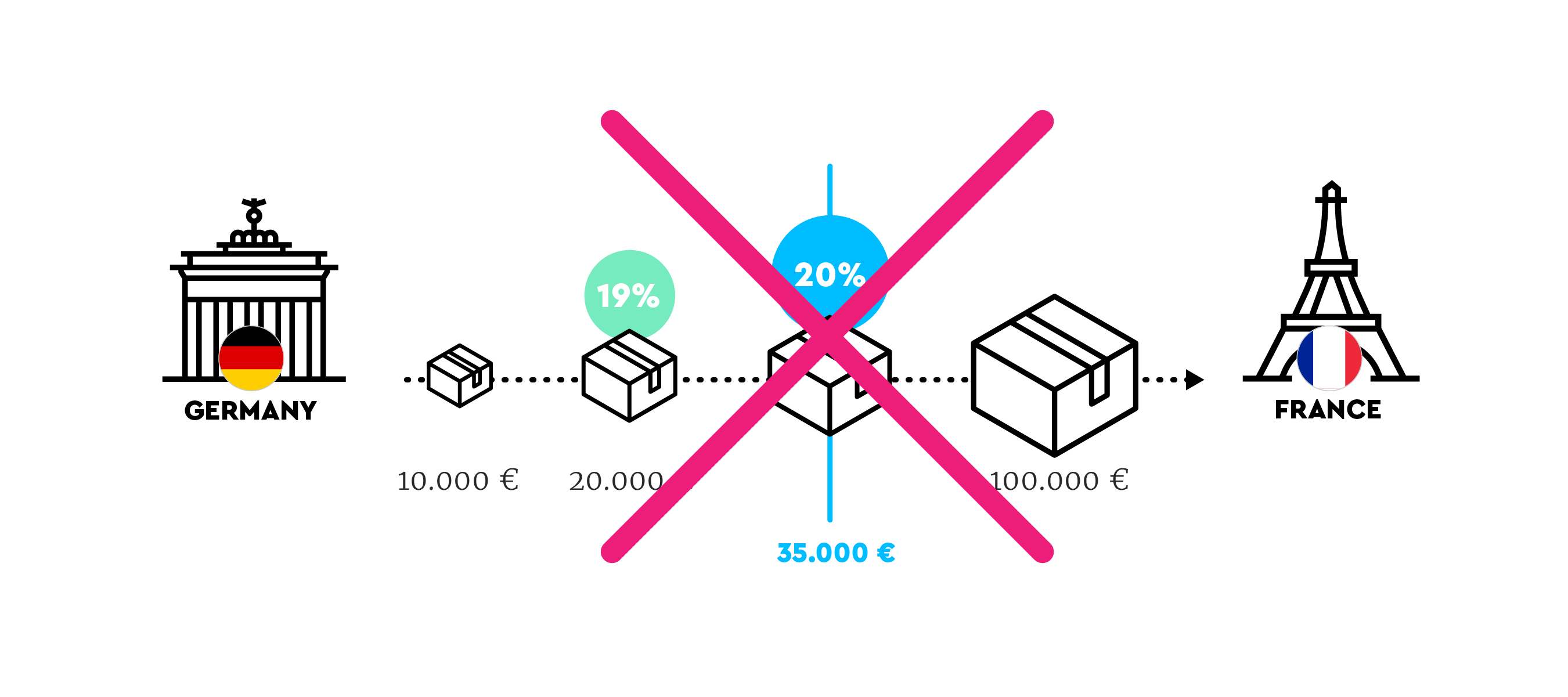

- The previous distance sales thresholds of individual EU countries (between €35,000 and €100,000) for sales to customers abroad no longer apply.

- Now an EU-wide distance sales threshold of €10,000 applies to all EU countries.

- This makes the majority of e-commerce sellers liable for VAT in every EU country to which they send even one parcel.

- VAT from such distance sales can be declared for all EU countries via the OSS. This means that you must determine the right VAT rate for every transaction.

- OSS reports must be submitted quarterly within one month of the end of the previous quarter.

- You have to pay VAT centrally when using the OSS to your relevant tax authority. The relevant tax authority then sends the VAT amounts to the relevant EU countries.

- Local VAT registrations and submission of VAT returns in other EU countries will no longer be necessary for such distance sales when using the OSS.

- Use of the OSS scheme is voluntary.

- If you use warehouses (or fulfilment structures) abroad, e.g. with Amazon Pan-European FBA or Amazon Central Europe, you still have to carry out local VAT registrations and submit VAT returns in the EU country where the warehouse is located.

- You cannot report B2B sales in the OSS. Therefore, you still have to file VAT returns for such supplies.

- Online sellers cannot declare local B2C supplies. That means if you sell goods to a consumer and the goods do not leave the country, that supply has to be reported in a local VAT return.

- When using the OSS, every transaction has to be checked to see if it actually qualifies for the OSS, or needs to be reported via a local VAT return. Taxdoo can handle this distinction automatically and make it available in a form that is ready to upload.

- Taxdoo can also provide you with all transaction data for OSS reporting in a structured form, as well as handle the necessary registrations and returns in other EU countries.

Watch our short video about the OSS:

Now you have an overview of the OSS we will tell you about it in more detail.

New Tax Obligations with the One-Stop-Shop Scheme in (Almost) All EU Countries

Until 2021 distance sales thresholds applied for each EU country. When you exceeded a country’s threshold – anywhere between €35,000 and €100,000 – meant:

- Each sale above the threshold, including the one taking you over the threshold, had to be taxed in the destination country with the correct VAT rate, varying between 17% and 27%.

- You had to notify the local tax authority in the destination country and register for VAT.

- VAT returns had to be submitted on an ongoing basis to the local tax authority, and you had to pay VAT on those sales.

Important: You’ll still need to deal with distance sales thresholds for a few more years for company audits and special VAT audits, since you can be audited by the tax authorities several years later.

The OSS has simplified many aspects of VAT for e-commerce sellers. It means VAT returns and payments in other EU countries can be made in just one country.

But this will only be possible for certain types of transactions. Sellers that take part in Amazon’s Pan-European FBA programme, or use other cross-border fulfilment systems, will require other solutions to be VAT-compliant.

EU VAT E-Commerce Package: Distance Sales since 1 July 2021

The EU’s VAT e-commerce package, which all EU countries had to implement into national law by 1 July 2021, means the end of all national distance sales thresholds. Instead there is now just one EU-wide threshold of €10,000.

What Transactions Are Relevant for the €10,000 Threshold?

The new €10,000 threshold is relevant regarding all sales to EU consumers. The following transactions fall within the threshold:

- Intra-community distance sales and

- Digital services (e.g. streaming or e-books)

If the threshold is exceeded, all subsequent distance sales to other EU countries (intra-community distance sales) are taxable in the destination country. The country of destination is always where the goods are located at the end of the dispatch or transport. As a result even one sale to another EU country – for example from Poland to Lithuania –requires a VAT registration, subsequent filing of VAT returns and paying VAT in Lithuania. To sum up: a lot of work for many online sellers which can be handled with the OSS (see in a moment).

Since the VAT reform took effect in the middle of 2021, the question arises as to how the different old distance sales thresholds and the new one need to be calculated for 2021.

Application of the Standard Distance Sales Threshold in the 2021 Tax Period: Distance Sales Thresholds Are Not Halved

In terms of the standard threshold of €10,000 for distance sales and digital services, many of you are asking yourselves how this distance sales threshold should be applied in the 2021 reporting period, during which both the old system of distance sales regulations, including national distance sales thresholds, and the new OSS rules, come together.

Please note that for 2021, the turnover threshold of €10,000 should not be applied on a pro rata basis in line with the old regulations.

You would therefore be justified in asking where the simplification in this VAT reform for online trade comes in.

The answer lies in the technology of the OSS.

What is the One-Stop-Shop?

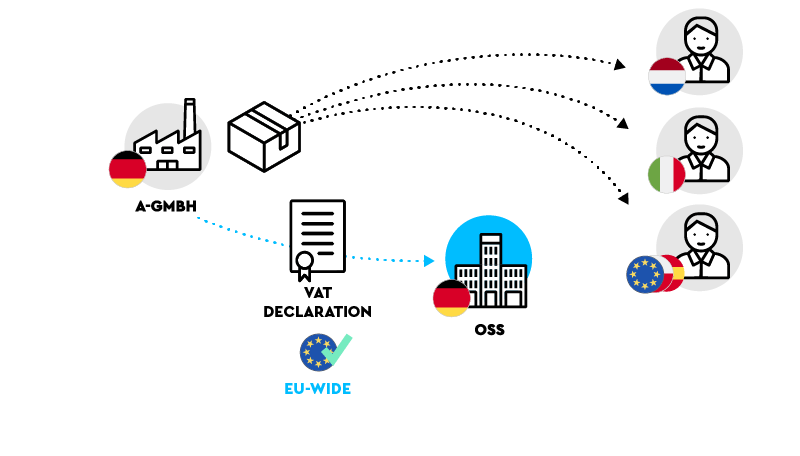

The OSS is a platform locally developed by each EU country and serves as a single point of contact for VAT compliance for certain transactions.

Online sellers that become liable to pay VAT in other EU countries as a result of their distance sales can report their sales through the OSS and also settle their VAT payments on the platform. The VAT is then distributed to the relevant EU countries.

This means that you do not have to register for VAT purposes in each individual EU country to file VAT returns because you have exceeded the €10,000 EU-wide threshold.

The following special features of the OSS procedure create additional incentives to use this technology:

- Anyone reporting their intra-community distance sales (distance sales) through the OSS doesn’t have to issue invoices for these supplies.

- The reporting period splits the year into quarters; January to March, April to June, July to September and October to December.

- OSS reports must be submitted by the end of the following month, so by 31 January, 30 April, 31 July and 31 October of each year for the previous quarter.

- The payment is also due when the OSS declaration is due.

- The OSS declaration as well as the payable VAT have to be transferred to just one national tax authority.

- Corrections to incorrect OSS declarations or refunds must be made in your next OSS declaration. This means that previous OSS declarations do not need to be corrected, as this is always done in the current OSS declaration.

That may sound good regarding the OSS, but there are some negative aspects you have to keep in mind.

Who Benefits from the One-Stop-Shop and Who Will Find It More Complicated?

Anyone who has dealt with VAT regulations for some time knows that reforms tend to set off a race between the tortoise and the hare – between rigid standards and agile reality. Particularly in the dynamic environment of e-commerce, major legal reforms that seek to simplify things seem predestined to fail.

This can also be seen with the OSS. While some may benefit from the scheme, e-commerce as a whole does not.

What Transactions Cannot Be Reported via the One-Stop-Shop?

In e-commerce, the OSS will only be a fundamental simplification for companies that dispatch products from a single central warehouse to consumers in other EU countries.

This is due to the fact that only distance sales can be reported through the OSS – i.e. sales from one EU country to customers in other EU countries. Consequently, you cannot report the following transaction types via the OSS, which will be explained in the following:

- Local B2C and B2B supplies

- Intra-community transfers of goods

- B2B supplies of goods

Local B2C and B2B Supplies

Local supplies (B2B and B2C) which never cross the border of another EU country, cannot be reported in the OSS.

Intra-Community Transfers of Goods

Another important topic which is also not covered by the OSS but is commonly used in the e-commerce world relates to so-called intra-community transfers of goods. If you for example use fulfilment structures such as FBA (Pan-European and Central Europe) your goods might be transported cross-border from one fulfilment warehouse to another although no sale is the reason for that. This intra-community movement has to be reported for VAT purposes.

In the case of intra-community transfers of goods, you basically have two transactions to consider:

- In the country of departure of the goods, this is generally considered a tax-exempt intra-community supply of goods.

- In the country of destination of the goods, there is generally a taxable intra-community acquisition. The VAT paid for this intra-community acquisition is regularly deductible as input VAT in the destination country, provided that the other input VAT regulations are also met.

In case you have such intra-community transfers of goods please be aware that you have to be VAT registered in the country of destination to declare the intra-community acquisition and have a valid VAT identification number (‘VAT ID’) in the country of destination available. Furthermore, for such transfers you have to issue a so-called pro-forma invoice and a so-called recapitulative statement as well as supporting documents. All these aspects are relevant so that intra-community supply is also tax-exempt in the country of departure.

Unfortunately you cannot declare intra-community transfers of goods via the OSS, so these still require a local VAT registration in the country of destination in order to be VAT compliant.

B2B Supplies of Goods

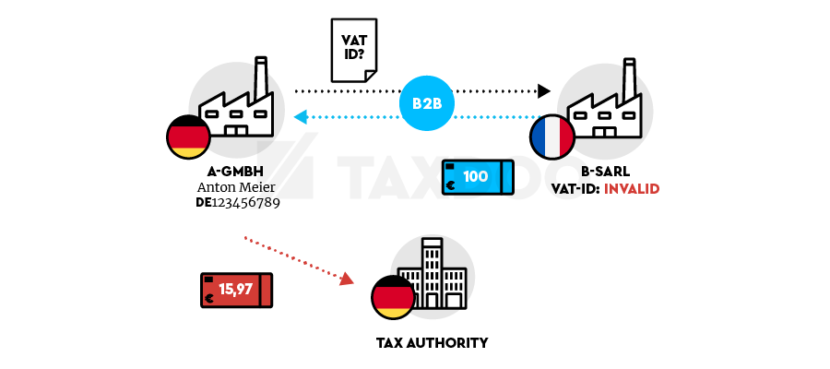

As already said, B2B supplies of goods which you supply locally cannot be reported via the OSS. The same applies regarding supplies of goods which you supply to another taxable person and which – indeed – cross the border of another EU country.

The question at this point is: How do you distinguish consumers from other taxable persons as different VAT consequences arise from this, especially in a highly automated process such as e-commerce?

The answer from a legal point of view is quite easy: A distance sale can be assumed if your customer does not provide you with a valid VAT ID of another EU country. But you still have to ask if there is one available and if you receive one, you also have to check if the VAT ID is valid.

From a technical point of view, Taxdoo can help you do that. Find out more about the importance of checking VAT IDs, how to do it, and how Taxdoo does it, in our blog post on the subject.

One-Stop-Shop for Marketplaces

From 1 July 2021 marketplaces, or so-called operators of ‘electronic interfaces’, also face a new VAT regulation; the so-called deemed supplier rule. Electronic interfaces are – for example – online marketplaces such as Amazon or Alibaba where online sellers can sell their products. Usually, online sellers have to declare VAT for their sales, but in some scenarios the operator of the electronic interface (e.g. Amazon or Alibaba) must declare and pay VAT instead, because they are treated as a deemed supplier. The operator of the electronic interface is the deemed supplier if the recipient of the goods is a consumer if:

- Goods are within the EU and the online seller is located outside the EU (third-country).

- Goods are outside the EU and need to be imported into the EU. Here the intrinsic value should not exceed €150. Please be aware that the location of the online seller is not relevant for that scenario.

If one of the scenarios apply, the operator of the electronic interface is the deemed supplier and has to declare and pay VAT. Generally, the same VAT aspects apply here for the electronic interface as for the online seller concerning the OSS. So, the operator can use the OSS to declare intra-community distance sales. However, the operator can also report local supplies of goods if he is the deemed-supplier.

This special regulation shows that both – electronic interfaces as well as online sellers – have to be aware of VAT implications and to be sure who actually owes VAT for a certain transaction.

Note: The background to this regulation is that marketplaces based in the EU are often more accessible to the European tax authorities than online retailers based in third countries. In order to reduce the administrative burden at this point and to avoid local registration of interface operators in all EU countries, operators of electronic interfaces can use the OSS procedure.

Amazon Seller?

On the Taxdoo blog you can find out more about VAT for Amazon FBA or VAT for Amazon Pan-European. You can also see all our posts about Amazon.

OSS and Issuing Invoices

Generally you are obliged to issue invoices for taxable transactions. This also applies regarding distance sales. But if you report these distance sales via the OSS, the invoice obligation is waived.

Which VAT Rate for What Product in Which EU Country? The Challenge Only Grows!

With the new regulations regarding distance sales, more and more online sellers are faced with highly complex topics regarding VAT rates. Even if you use the OSS, this challenge still remains on you.

The subject of VAT rates in the EU is quite complicated. EU law allows the following range:

- Standard tax rate: Here the range in the EU is between 17 and 27 percent. The legal minimum is 15, and there hasn’t been an upper limit for several years.

- Reduced tax rate I: This must be at least 5 percent and less than 15 percent – the application is limited to the products listed in Appendix III of the VAT Directive.

- Reduced tax rate II: The same conditions apply as for the reduced tax rate I.

- Zero Tax Rates: As the name suggests, the tax rate here is zero percent. This is not to be confused with a tax exemption.

- Special rates: These can be chosen at will – but always only after approval (and often a time limit) by the EU Commission.

This range of VAT rates, which is fully utilised by many EU countries, makes determining the right VAT rate in the context of the new regulation effective 1 July 2021 particularly challenging for e-commerce.

How can an online retailer with a range of 5,000 products and tax obligations in all EU countries from 1 July 2021 determine the VAT rates for all 5,000 products and all EU countries with legal certainty?

Ultimately, this will only be possible in an automated manner – for example via a unique product feature such as the so-called customs tariff number. With the help of the customs tariff number, each product can be classified worldwide, so that the All in all, there are quite a few challenges that the new legal regulation brought with it. We have summarised these in a checklist. VAT rates can also be determined automatically – then via corresponding databases.

Import-One-Stop-Shop for Distance Sales from Third Countries

As part of the change in the law on 1 July 2021 a single point of contact for imports – the so-called Import-One-Stop-Shop (IOSS) – was also introduced. The IOSS can be used to report distance sales imported from a third country with an intrinsic value of up to €150.

The IOSS can be used by entrepreneurs based in the EU as well as by entrepreneurs based in ‘third countries’ (non EU countries). Entrepreneurs have to file a corresponding registration with the responsible tax authority for the special scheme.

The IOSS can only be used once the tax authority has issued an IOSS identification number to the entrepreneur. In contrast to the OSS, IOSS reports must always be sent to the tax authority on a monthly basis.

Find out more about Taxdoo’s IOSS solution here.

Are You OSS-Ready? Checklist for the One-Stop-Shop Process

- Ensure that you can determine VAT rates automatically and throughout the EU – ideally via the customs tariff number!

- Register for the OSS! We will show you how to do this below.

- If you take part in the Amazon Pan-European programme – or similar programmes – then you have to identify your distance sales and then report them via the OSS, but all other transactions (B2B transactions, input taxes and local sales) continue to have local registrations in other EU countries.

- Make sure regularly that if point 3 applies to you, you do not report transactions twice (OSS and local registration) or not at all! This can happen quickly due to the added complexity.

Conclusion about the One-Stop-Shop: Additional Requirements for VAT Obligations for Most Online Retailers

The legal reform on 1 July 2021 is extensive and complex for you as an online retailer. But you can take the following key facts with you as a conclusion:

- Abolition of national delivery thresholds and the introduction of an EU-wide sales limit of €10,000.

- Tax liability in (almost) all EU countries, even if only small sales are made in individual countries.

- Central reporting of distance sales via the OSS procedure in the country of domicile of the online retailer (local registrations are no longer necessary for this)

- Necessity of local registrations when participating in Amazon’s Pan-European or Central Europe programmes or various fulfilment centres/warehouses

- Need for EU-wide determination of the applicable tax rates for the entire product portfolio

Design and establishment of additional VAT reporting processes necessary to map different transaction types (distance sales via OSS, intra-community transfers / purchases via local registrations)

Taxdoo Offers One-Stop-Shop Solutions and More

If you want to know more about how you can map OSS obligations, VAT compliance, financial accounting and much more efficiently and securely via one platform, then use this link to choose an appointment for your individual and free initial consultation with the e-commerce and VAT experts from Taxdoo!

Taxdoo Is the Platform for Automated and Secure VAT Processes

In addition to processing ongoing EU-wide VAT compliance, Intrastat and financial accounting, Taxdoo also maps numerous other VAT services for the leading online retailers in Europe via a unique platform.

We are able to report your remote sales automatically and more easily than ever via the OSS.

The IOSS can only be used once the tax authority has issued an IOSS identification number to the entrepreneur. In contrast to the OSS, IOSS reports must always be sent to the tax authority on a monthly basis.

Find out more about Taxdoo’s OSS solution, available with all our packages, including our free Starter package, here.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

VAT identification number and country of origin for Intrastat reporting: New requirements from 2022