What must be included in a German invoice?

In this article we explain to you in which cases you must issue invoices and what must be included in them.

First of all we would like to point out that Taxdoo is now an official partner of DATEV and can provide you with the most advanced FiBu interface for all online revenues and Amazonfees – see here.

Classic to-DATEV converters cost unnecessary time, money and carry risks – see here.

When do I have to issue an invoice as an online merchant?

If you sell goods or services via your own webshop or electronic platforms such as e.g. Amazon or eBay, you have probably already asked yourself the question Am I actually obliged to issue an invoice to my customers? The answer to this question depends on who your customers are.

Private client or entrepreneur?

If you as a trader provide a service – this can be a delivery of goods or a service – to another entrepreneur, you are obliged to issue an invoice within six months. This obligation only applies to a few tax-free services, which are not very important in the e-commerce sector.

If your customer is a private person, you do not have to issue invoices. This changes for cases where you send goods to private persons in other EU countries. In these cases you are obliged to issue an invoice for each delivery made.

Often customers will also ask you for an invoice if there is no legal obligation to do so. Most of you will probably offer this additional service – especially if the feedback of your customers is publicly visible, e.g. on market places like Amazon eBay.

As a trader, it will probably be difficult for you to distinguish between a business and a private person as a customer. For example, if you oversell Amazongoods, the information available to you will often not allow you to determine beyond doubt which category your customers belong to. The question of whether you should always issue an invoice in case of doubt must be weighed up by yourself.

In the following, we will show you how much effort is involved in preparing the invoice and what risks you must expect if you do not comply with this obligation.

Mandatory information in the invoice

If you are legally obliged to issue an invoice, the legislator prescribes the minimum content of the invoice. Section 14 (4) of the Value Added Tax Act contains an overview of these so-called mandatory invoice details.

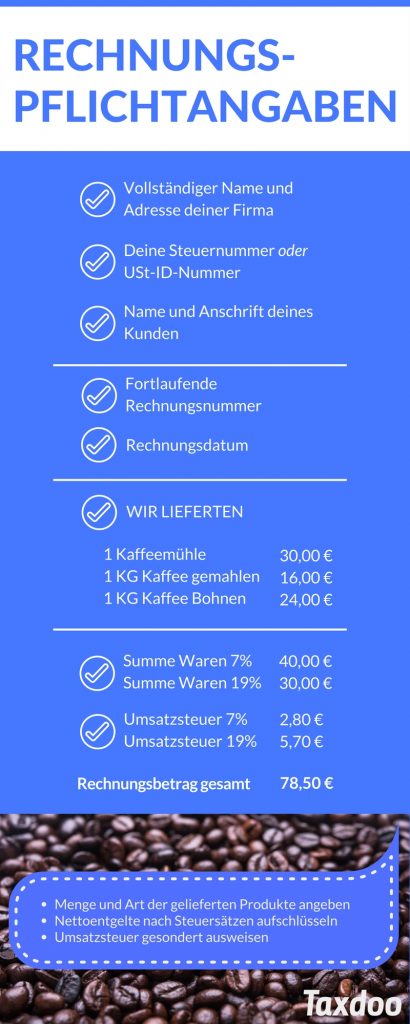

Correct addressing

It is important that you as a dealer give your full address. The same applies to the address of your customer. You should avoid P.O. box addresses if possible.

Tax number or VATID number

In addition, you have to list either your tax number or your Value Added Taxidentification number (VAT-IdNr.). If you also send to other EU countries and to other entrepreneurs, it is best to use only the VAT-IdNr.

Consecutive invoice number

From the point of view of the tax office, it must be ensured that each invoice is unique. For this reason, you must include a consecutive invoice number on each invoice. There is no regulation how this number has to be structured (in Germany). You can also use combinations of letters and numbers. It is also not mandatory that all invoice numbers have to follow each other without gaps. The simplest form of invoice number is surely to create invoice numbers that consist of the respective calendar year and a consecutive number. For the 36th invoice you want to create in the calendar year 2016, you could use the following invoice number: 36/2016.

Date of invoice and time of performance

Other required contents are the date of invoicing and the time of your service or delivery. Both can coincide in time. Since the tax office only wants to know in which month a turnover was generated, the following note on the invoice is often sufficient in e-commerce:

The time of delivery / service corresponds to the invoice date.

Type and quantity of products

The main part of your invoice must be a detailed statement of the quantity and type – the usual trade description – of the goods or services supplied.

Separate listing of net fees and VAT amounts

Finally, you must list the net remuneration, the amount of VAT (including tax rate) and the total gross amount separately.

If you charge for services or goods that are subject to different tax rates, e.g. coffee (7% Value Added Tax) and coffee grinders (19% Value Added Tax), you must list the respective net fees and the applicable VAT amounts (including tax rate) separately.

The following infographics summarize the above-mentioned mandatory billing information in a compact form (click to enlarge).

What simplifications are there?

Invoices for an amount of less than 200 euros gross (this amount has been valid since 01.01.2017, before that 150 euros gross was the limit) get by with less compulsory information (§ 33 – Value Added TaxImplementing Regulation). The beneficiary and the time of the service do not have to be specified. It is also sufficient to show only the gross amount and not the net remuneration and tax amount separately.

However, if you send goods to private customers within the EU, you are not allowed to use this simplification rule. In these cases, you must always issue an invoice with all the mandatory invoice details mentioned.

What are the special features of electronic invoices?

In recent years, electronic invoicing has probably become the most popular method of invoicing. We would therefore like to take a brief look at the special features of what is probably the simplest way of invoicing.

What counts as an electronic invoice?

The law defines an electronic invoice as any invoice that is sent, for example, by e-mail or download. Since July 2011, an electronic signature is no longer mandatory, which has significantly promoted the spread of e-invoices.

Obligation of the customer to give his consent

However, if there is an obligation to issue an invoice, as is the case for example with goods deliveries to private customers in other EU countries, you may only choose the electronic form of dispatch if the customer does not expressly request a paper invoice.

In practice, this approval is often handled via the general terms and conditions. Legally, however, the payment by the customer can also be regarded as his tacit consent. Thus the legal threshold for the creation of electronic invoices is fortunately not very high.

No invoice is not a solution either

In view of the effort and risks described above, the idea could be born of not issuing invoices despite the obligation to do so. However, this is an administrative offence that can be punished with a fine of up to 5,000 euros by your tax office. Furthermore, under German law, the recipient of the service would have the possibility to withhold payment of your service until an invoice is issued.

The easiest way is to always create a complete invoice automatically (e.g. with FastBill). This way you never run the risk of accidentally sending invoices with insufficient information, such as duplicate invoice numbers or wrong tax rates.

Weitere Beiträge